|

Click here to download this page as a print factsheet.

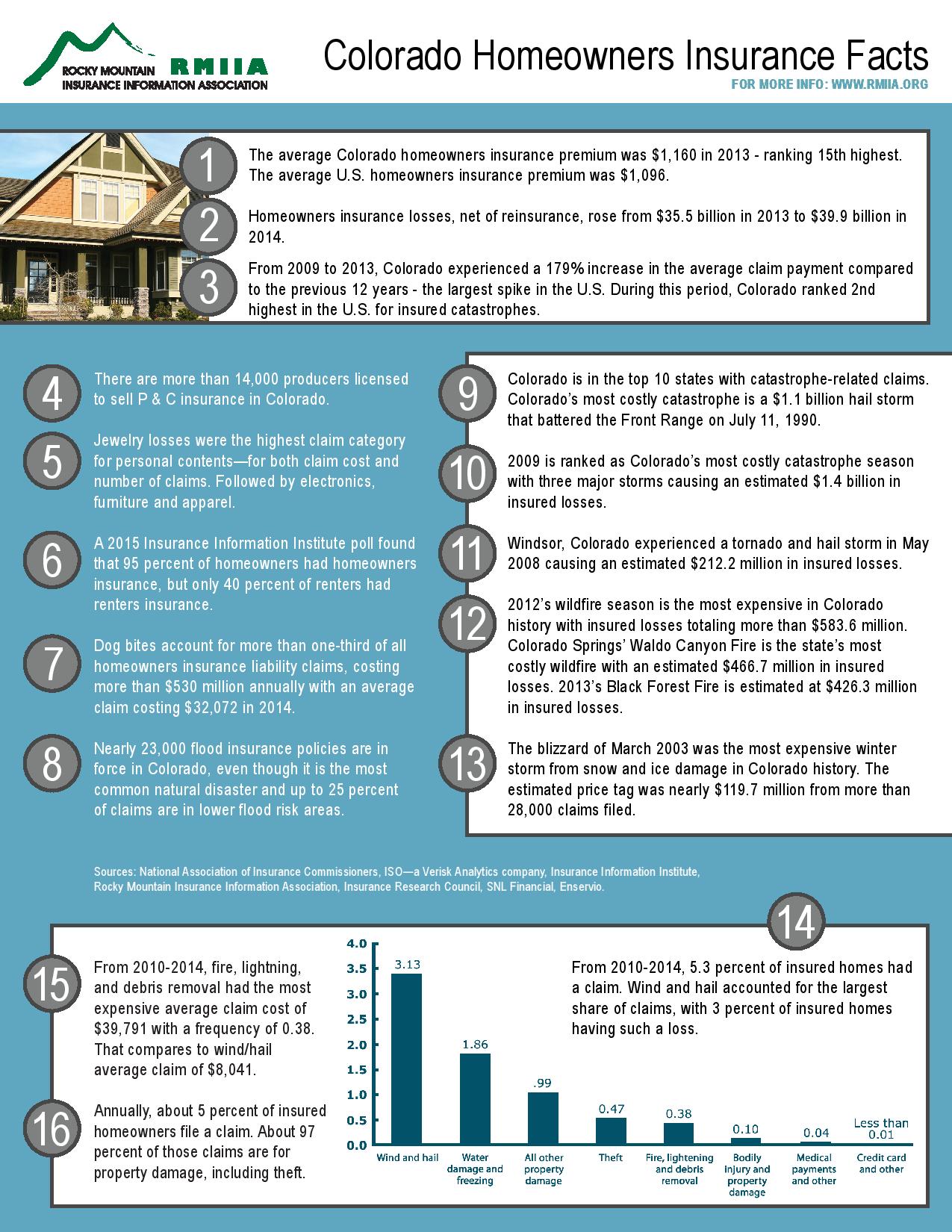

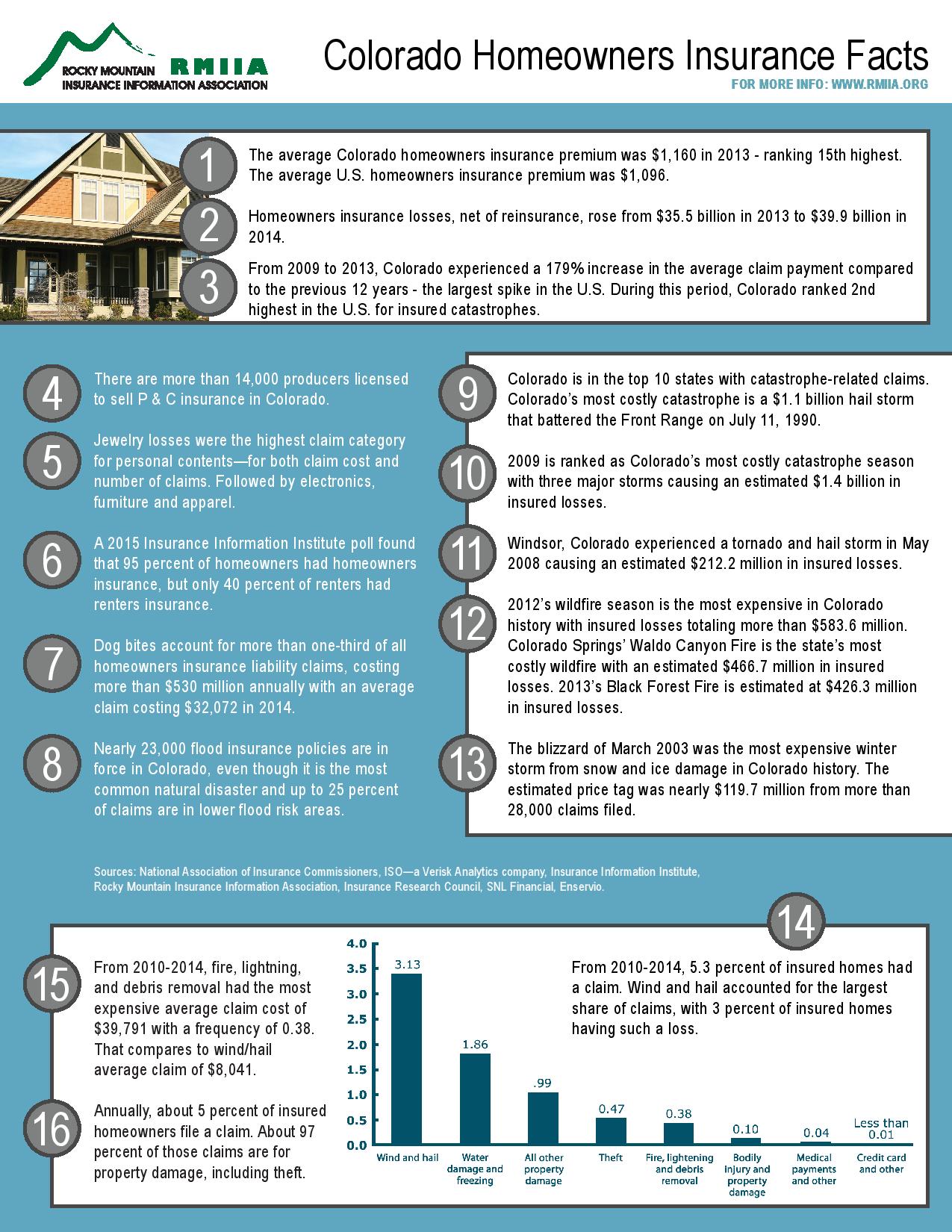

Colorado is experiencing a "new normal" as it now ranks second in the nation for homeowners insurance catastrophe claims. This is a result of what Coloradans have lived through in recent years—season after season of widespread damaging hailstorms and the state's most destructive wildfires. Since this volatile trend of catastrophic insured losses is unprecedented, it requires homeowners to better understand how this is impacting Colorado's insurance marketplace and what steps they can take to protect their finances and property. Colorado is experiencing a "new normal" as it now ranks second in the nation for homeowners insurance catastrophe claims. This is a result of what Coloradans have lived through in recent years—season after season of widespread damaging hailstorms and the state's most destructive wildfires. Since this volatile trend of catastrophic insured losses is unprecedented, it requires homeowners to better understand how this is impacting Colorado's insurance marketplace and what steps they can take to protect their finances and property.

Key Facts:

- From 2009-2013, Colorado experienced a 179% increase in the average claim payment per insured home compared to the previous 12 years—the largest percentage increase in the U.S. Source: Insurance Research Council

- Colorado has nearly 100 companies selling homeowners insurance, so despite a pattern of costly hailstorms and increased threat of catastrophic wildfires, a competitive, stable insurance market still exists.

- With spiking claims costs and increased risk, Colorado homeowners insurance premiums are rising, however the average premium remains about $1,000 annually.

- There is no evidence of widespread homeowners insurance cancellations and non-renewals in Colorado. The average non-renewal rate for the majority of insurance companies remains less than 1% of insured policies.

- State law mandates insurance premium increases be justified and not unfairly discriminatory. Rates and underwriting guidelines (basis for insuring homes) are highly regulated by the Colorado Division of Insurance.

- Homeowners who live in higher risk properties, especially in the Wildland Urban Interface (WUI), may have to shop to find insurance and pay a higher premium that reflects increased risk, however there is no evidence that insurance is unavailable. Some may have to move to a higher risk or surplus lines insurance company that specializes in high risk.

Homeowners Insurance Non-Renewal: What Does It Mean?

There is a big difference between cancellation and non-renewal. Insurance companies cannot cancel a policy that has been in force for more than 60 days except: If you fail to pay the premium or if you have committed fraud or made serious misrepresentations on your application. RMIIA Homeowners Insurance Guide There is a big difference between cancellation and non-renewal. Insurance companies cannot cancel a policy that has been in force for more than 60 days except: If you fail to pay the premium or if you have committed fraud or made serious misrepresentations on your application. RMIIA Homeowners Insurance Guide

Non-renewal is a different matter. Either you or your insurance company can decide not to renew the policy when it expires. Your insurance company must give you 30-days notice and explain the reason for non-renewal. If you think the reason is unfair or want further explanation, call the insurance company or the state division of insurance. A policy could be non-renewed for a variety of reasons—from a company deciding to discontinue that line of insurance to a property no longer meeting an insurer's underwriting guidelines. If you or your property is now considered too high risk for your particular insurance company, you will not necessarily be charged a higher premium at another insurance company. RMIIA Avoiding Non-Renewal

Colorado's New Risk Realities

WUI property owners are often required by their insurance companies to do mitigation, and in many cases, if they work with insurers and fire officials to make their property safer, they can keep insurance. If WUI homeowners refuse to do mitigation they can lose insurance. Colorado Wildfire & Insurance Guide | RMIIA Mitigation Poll WUI property owners are often required by their insurance companies to do mitigation, and in many cases, if they work with insurers and fire officials to make their property safer, they can keep insurance. If WUI homeowners refuse to do mitigation they can lose insurance. Colorado Wildfire & Insurance Guide | RMIIA Mitigation Poll

- A January 2015 statewide independent poll commissioned by RMIIA found that 96% of Coloradans said it is "very important" or "pretty important" for homeowners to undertake fire mitigation efforts.

- 65% of Colorado respondents said insurance companies should not be forced to continue insuring homeowners who refused to do mitigation, while 55% agreed that insurance companies should not be required to sell them insurance.

- Colorado insurers are partnering with communities on model mitigation programs like Boulder's Wildfire Partners. Some companies are accepting the program's mitigation inspections for insurance renewals.

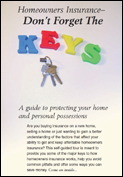

|